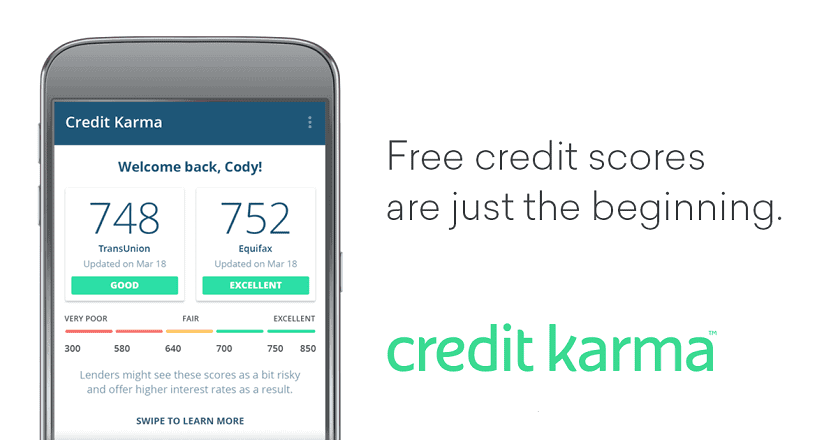

Knowing your credit report is extremely useful if you are attempting to prepare for your monetary future. Credit Karma is among the best and most popular credit reporting websites/apps.

It allows users free access to their credit history and credit report and helps people compare financial products that they may receive, such as loans or charge cards focused on their credit level.

Credit Karma is an excellent starting point for monitoring your financial resources’ health. Still, it has some restrictions in terms of the credit referral companies that it works with and the features that it provides.

Sites and Apps Like Credit Karma for Credit Scores

If you’re searching for an alternative to Credit Karma, think about a few of the following options. We have investigated and curated some terrific alternative websites and apps similar to Credit Karma for credit reporting (and far more) in the list below.

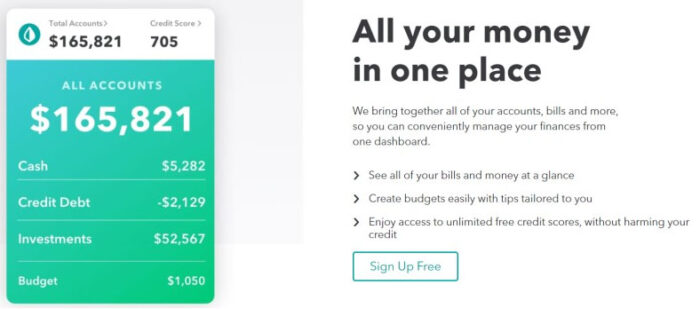

1) Mint

Mint is an app that uses budgeting, bill payment, and investment tracking all in one useful app. It likewise offers credit history, free of charge, with credit notifies whenever TransUnion gets information that might affect your credit score.

This means that it assists you not just keep an eye on your current score for borrowing functions; it also works as an early warning sign for identity theft.

If you are informed, your score has altered because someone opened an account, which individual wasn’t you; then, you will be able to do something about it rapidly– ideally, before your credit report is significantly damaged.

2) Credit

Credit.com is an application and browser-based credit score tool which reports your Experian credit score. The app is free of charge, without any charge card required to open an account.

There’s an Android and Google Play version of the app readily available, and you can access the information through your web internet browser as well if you prefer.

In addition to informing you of your score, Credit will also describe how scores are calculated and encourage users to enhance their scores.

The tool works for credit education and repair work, and considering that you can set up alerts, it helps in the battle against identity theft.

3) Credit Sesame

Credit Sesame bills itself as an individual credit management service that enhances their credit rating and total finances.

It uses TransUnion to provide a clear & easy to understand overview of the elements that affect an individual’s credit ranking.

It likewise offers a service that helps individuals pick cards or loans appropriate for their finances. This can be beneficial for individuals with an excellent credit rating, allowing them to recognize the marketplace’s best deals.

It is likewise valuable for those in building their credit rating. It will help them pick the monetary items that use the very best costs and the very best possibilities of being accepted with their current score.

4) Annual Credit Report

While the majority of the product or services in this list offer unlimited reports from one specific firm, the Annual Credit Report works quite differently.

It offers users a free report from the three main credit reference agencies: TransUnion, Equifax, and Experian, once per year.

This assists individuals check out the marketplace for a significant purchase, such as a mortgage, because it helps prospective customers make sure that their monetary information is precise throughout all the major credit reporting groups.

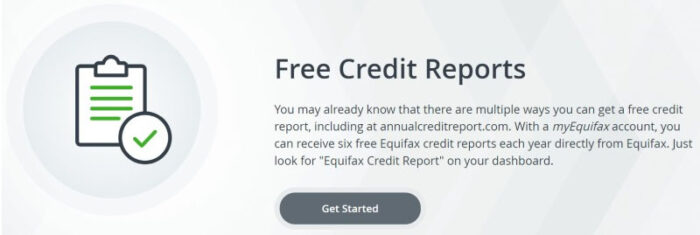

5) Equifax

If you desire a bare-bones report and don’t want to offer your information to an intermediary to get them, then you have the choice of going straight to the credit reference agencies themselves.

Equifax permits users to ask for six complimentary credit reports annually. This is a bare-bones service. There are no credit cards or loan matching tools, and no notifies.

The benefit, nevertheless, is that you are going direct to the source. This indicates less danger of spam or marketing calls from the developers of the application and the people who are trying to lend.

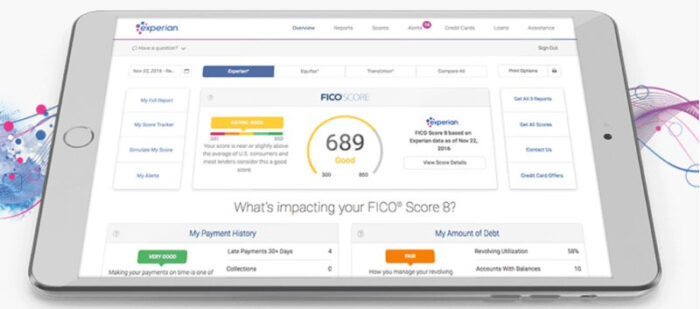

6) Experian

It is a aid-for tool that inspects Experian, TransUnion, and Equifax credit reports daily and after that informs users if they have changed.

The credit report is based on FICO Score eight for most of the calculations, but for some types of credit, other scores might be used.

This tool is a great alternative for people who want to maximize their credit report, planning a house purchase quickly, and those worried about identity theft. There is a regular monthly fee; however, the first month has a low introductory price, enabling users to try the service for minimal risk.

7) TransUnion

TransUnion offers users to ask for one credit report per year, free of charge. Everybody who does not utilize a credit reporting tool ought to consider benefiting from this.

If you desire more than one report annually from TransUnion, then you can register for their year-round service, which enables you to access your credit report as typically as you want.

This service also informs you if new accounts opened in your name, changes to your charge card balance, or any negative reports made by lenders.

8) CreditWise

CreditWise is a totally free credit tracking app that is produced by Capital One. While a lending institution makes the app, it doesn’t impact your credit score to set up an account.

The service has some rather helpful tools, such as a simulator that permits you to see what is likely to take place if you make particular changes to your financial practices, such as paying off a loan or increasing the limit on your charge card.

This is a beneficial form of financial education that can help you prepare yourself to make significant loan applications in the coming months or years.

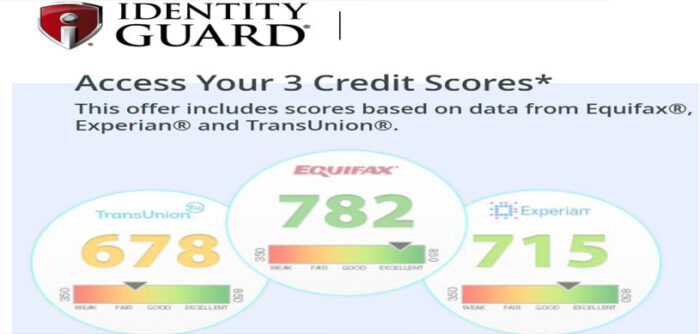

9) Identity Guard

IdentityGuard is a tool that assists in securing users from identity theft. It is easy to establish an account, and when you are up and running, you can get informs about significant modifications to your credit record, offering you an early warning in the event of possible scams.

One especially nice aspect of the service is that it has tiered prices, with the choice of signing up for a family account and protecting not only your financial details but that of your partner and children too.

Charge account opened with a child’s SSN are a common scam nowadays and something that many young adults just learn about when they start their own monetary life.

10) Bankrate – Quizzle

Bankrate– Quizzle is a credit report tool developed when the Bankrate group obtained Quizzle.

This credit improvement tool provides credit reports, charts, and a breakdown of the elements impacting your credit score.

Registering for an account is complimentary, and the tool provides access to your full credit report with weekly updates on your rating, informs when your credit report modifications, and tracking tools to help you understand how your credit report is changing over time. The gadget also offers tailored rates for monetary items.

11) WalletHub

WalletHub offers free credit scoring upgraded daily, along with totally free credit reports and an analysis of the aspects that enter into creating your credit report.

The tool is accessible through a site and also a mobile app. Signing up is quick and simple, and the service will assist you to discover charge card, loans, rewards cards, and mortgages that might be suitable for you based upon your present credit history.

Many free credit history tools provide just weekly or regular monthly updates, so having access to an everyday upgrade makes this an appealing option.

12) Discover Card FICO Score

It provides users with a FICO rating based upon info from TransUnion. FICO scores are the most regularly used scores by the significant loan providers.

The score is based on the quantity of cash owed, the length of the individual’s credit report, just how much new credit has actually recently been opened, and the kind of that credit.

Discover offers users a frequently upgraded score, with the date that the score was updated being suggested on the dashboard.

The score is a picture and might not be updated as often as some other tools, but it is totally free to access and a great alternative for individuals looking to discover what information TransUnion has on their records.

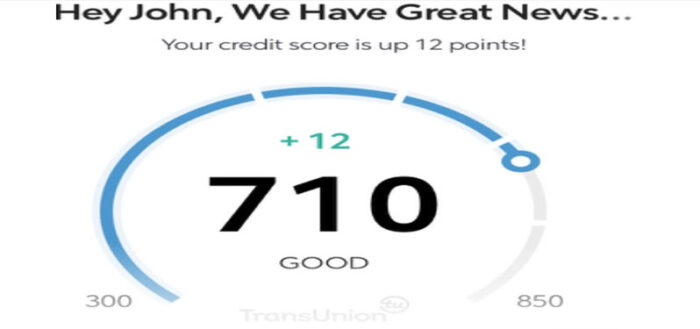

13) Chase Credit Journey

Chase Credit Journey is a complimentary credit score reporting app that is open to anyone who wants to inspect their score, even if they are not a Chase customer.

The application updates weekly and users can check their score as frequently as they want without worrying about the check adversely impacting their score.

The tool also offers a complimentary score simulator that assists people to comprehend how altering their monetary habits might affect their future scores. Users may likewise be given offers for loans or credit cards that match their financial resources.

14) PrivacyGuard

PrivacyGuard is the best premium identity theft protection tool that consists of credit reporting, rating tracking, and credit education services.

There is a sensible introductory deal for the service, allowing people to check it out without investing a lot of money.

Furthermore, users get access to their VantageScore and can ask for notifies for considerable modifications like negative marks on their account, significant balance modifications, or brand-new accounts being opened in their name.

There is likewise the option of daily credit monitoring that tracks all three significant credit reference agencies.

15) Rocket HQ

Rocket HQ is a complementary tool that provides users access to their TransUnion credit report and permits them to track their VantageScore.

The tool offers a number of monetary education tools to help people understand how their credit and individual financial resources work and gives answers to typical questions about home loans and loans.

Rocket HQ is complimentary to use, and inspecting your credit score with the service will not leave any significant marks on your credit report, so you can monitor your rating as frequently as you wish.

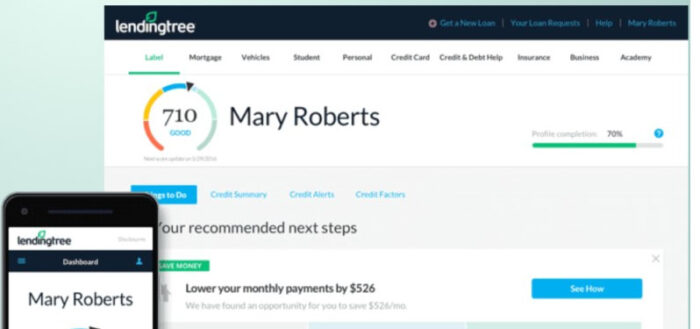

16) LendingTree

LendingTree provides a credit score service that offers users an easy to understand report of their credit history in-app or website type.

The service uses VantageScore 3, a rating created from merging the credit history reported by Equifax, TransUnion, and Experian.

This rating is not the score that most lenders use, however it is an excellent quote, and it is good enough to assist users in deciding whether they are on the right track with their current monetary practices. LendingTree’s easy-to-use app and easy signup process make it attracts many individuals.

17) NerdWallet Free Credit Score

Like numerous other tools, NerdWallet uses VantageScore 3.0 to enable users to keep an eye on their credit history.

This service is provided in app form for Android and iOS users and through their website. Users can view their score, monitor their rating for modifications thanks to weekly updates, use the simulator tool to get a concept of whether changing their credit line or paying down particular debts would be a good thing for their credit scores, and work to improve their credit report with cautious management thanks to the info provided.

18) myFICO

The myFICO app and site are run by FICO themselves and have tiered pricing based upon the user’s features.

The least pricey tier uses regular monthly updates on Experian credit files, while the other levels supply 3-bureau monitoring at numerous intervals.

All tiers use identity theft insurance coverage. The FICO score is the score that 90% of lending institutions use, so it is the most beneficial score for individuals to have if they are thinking about securing a significant loan soon.

Moreover, the tool costs more than most other services, but for some individuals, specifically those with families working towards a home mortgage, the insurance offering might make it beneficial.